By Anil Taneja,

World, January 19, 2026

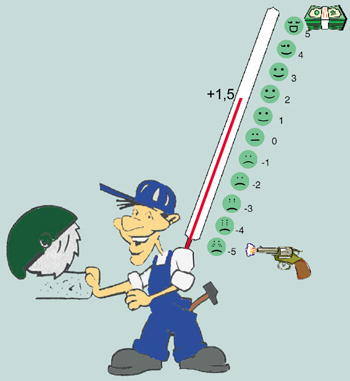

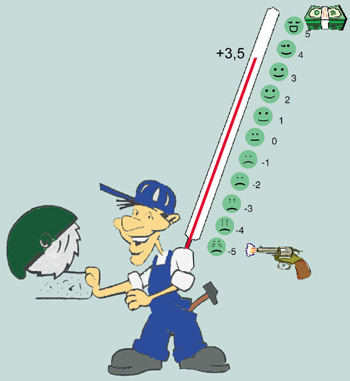

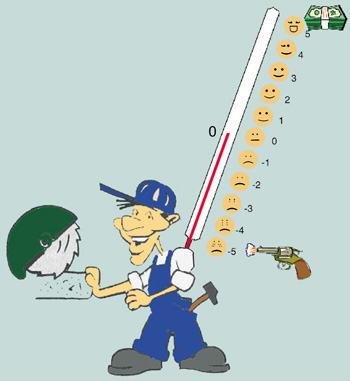

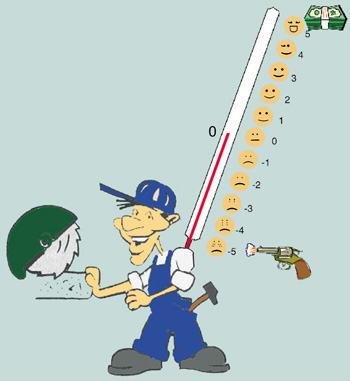

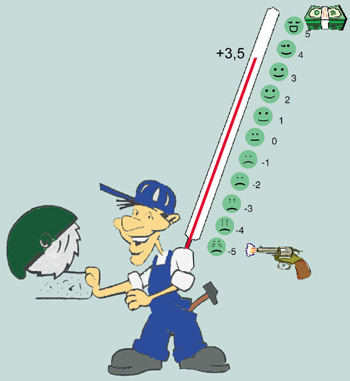

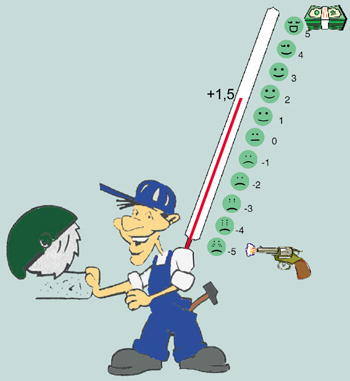

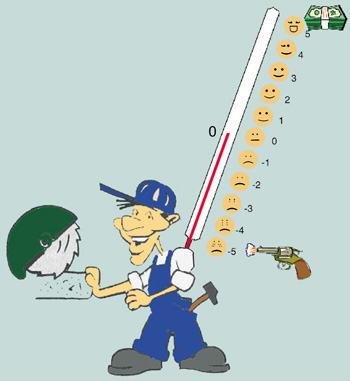

The year 2026 begins with the same degree of uncertainty that prevailed last year. The tariff wars may still not be over. The markets that were sluggish in 2025 are expected to remain so this year too.

Brazil, January 19, 2026

The Brazilian quartzite exports remain popular all over the world and availability is no issue with quarries production increasing all the time. The local market is also very dynamic.

Central / East Europe, January 19, 2026

The overall business mood is positive. The stone industry in Poland is doing very well with no shortage of projects. The huge oversupply of stone from everywhere puts tremendous pressure on prices and no single supplier is able to dominate the market. Other countries in the region continue to be stable markets though there seems to be a new cautiousness in the business atmosphere.

The Turkish industry remains in serious trouble with high inflation and interest rates creating a very difficult business environment.

China, January 19, 2026

The internal competition in the Chinese stone industry has always been severe, now even more so. The companies are exporting everywhere they can, but with such low prices is there any profitability at all?

East Asia, January 19, 2026

The East Asian countries economies have noted the effect of the slowdown in China and the huge oversupply of stone of all varieties, mostly from China.

India, January 19, 2026

The local market remains solid and keeps growing. Construction activity is now very dynamic in the Tier 2 and Tier 3 cities and demand in the rural areas continues to grow. Those companies working with local materials and selling in the local market, are doing well. Exporters are struggling.

Latin America, January 19, 2026

Mexico remains a dynamic market. Other countries are much smaller markets, but are stable.

Middle East and North Africa, January 19, 2026

Several major projects are going on in the Gulf countries, especially in the Emirates. Some major projects in Saudi Arabia have been postponed or cancelled though ongoing projects continue as before. Overall, the Gulf and the North African markets are extremely price sensitive. The volumes are there, but the margins are minimum due to large number of suppliers.

U.S.A., January 19, 2026

The biggest market also with the biggest uncertainty. The tariffs issue may still persist. Rising costs of building materials discourages the builders from undertaking new projects. Most likely the renovation market will remain strong. What happens if there is a serious correction in the stockmarket, no one knows.

Western Europe, January 19, 2026

2026 looks like being a year not very different than 2025. Sluggish demand. Shortage of skilled labour, companies closing down because of lack of transition to a new generation. Spain's construction and renovation industry is booming. Overall, the prices have stabilised.